«Sentii sul viso il vento del volo che fece impeto a salire, poi si fiaccò, girò come in un turbo, piombò verso lo scrìmolo del monte.

Icaro disse: “L’officina arcana era in una caverna del dirupo, dietro il porto d’Amniso a levante di Cnosso, erma sul mare.

Quivi all’innaturale opera intento era il mio padre, quivi i congegni del volo oprava senza incude e senza maglio.

Ben gli diedi travaglio e affanno, ché pareami troppo tarda la sua fatica per il mio dèsio.

E (le penne) sapeva inflettere con tanta arte, per imitar la curvatura della vita, che l’ala su la pietra inerte parea trepida e tepente e penetrata d’aere, ventosa come fosse per rompere dal nido o per posarsi dopo lungo volo»

(Gabriele D’annunzio, Ditirambo IV, Alcyone, 1941)

The Aerospace and Defence industry has always been a long-cycle business. Indeed, developments can only be understood by taking a medium to long-term view, reflecting the life of the aeronautical industry programs.

As Darren Hulst, Boeing’s Commercial Marketing VP, remarks, “stakeholders…know that it’s imperative to plan for the future”.

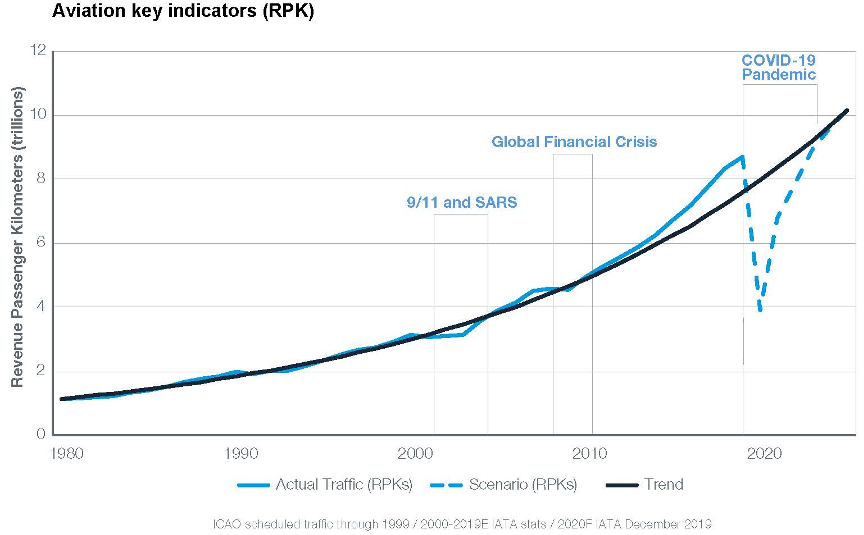

Indeed, it is no coincidence that industry investments ramp up at times of crisis, such as after the terrorist attacks of 11 September 2001 or during the 2007 financial crisis.

This is even truer today, with the health crisis having a particular impact on the air transport and commercial flight sector, affecting the entire fixed-wing industrial chain.

When the world’s largest aircraft manufacturer published its market outlook1[1] at precisely the time it was facing its own challenges in relation to the grounding of the B737 Max and ensuing issues, it once again demonstrated this bold attitude.

The dynamics of the industry are thus unchanged, underpinned by a robust tradition, not only technological but also of strong medium-term quantitative growth, and by development and innovation prospects that play a key role in the future transformation of the globe.

The crisis could be said to have provided new impetus to embrace the environmental aspect, and safety – not only of flight but in flight -, and has shaped strategies, such as average aircraft size.

Indeed, it is no coincidence that some directions, such as large aircraft like the A380, have been completely rethought, with Airbus announcing in 2019 that it was ending production, and infrastructure such as airports going down the same path.

Long-term growth prospects are thus confirmed and have even improved on analysts’ predications of just one year ago.

In the short term, the health emergency has driven up fleet renewal as a component of demand for new aircraft. This phenomenon has already been observed during previous short-term shocks, where airline companies bring forward the replacement cycle of its aircraft in operation which in normal times would be spread out in order to meet demand.

Indeed, the annual average growth rate of passenger transport in the last ten years was 6.5%.

In normal years, 2 – 3% of the fleet is retired; this rises to 4 – 5% in periods of crisis, such as the current one.

The fundamentals that have driven both the transformation and growth of air transport in the last half century have been confirmed in each cyclical phase, laying the basis for the expected recovery which everyone is hoping will begin in the 2021-22 two-year period.

This phenomenon is linked not only to demand, which has shown strong growth, particularly in the emerging markets, but also to the incentive that each crisis has given the industry to improve its products (aircraft) and services (transport).

The RPK measure used in commercial aviation showed a steady increase over previous decades, with an acceleration in the 2000s, punctuated by at least two shocks of global significance.

The recovery is expected to start with short-range and domestic flights, which will be the first to return to pre-crisis levels with the easing of restrictions. Estimates of sales2 of new aircraft are for around 18 thousand aircraft in the next decade, and around 43 thousand new airplanes over the next two decades.

Growth expectations for the quantity and value of freight transported and, thus, fleet expansion, are also solid for commercial transport, which was impacted to a lesser degree by the current situation. Deliveries of new cargo planes are expected to approximate 2,400 by 2039.

E-commerce is revolutionising purchasing patterns, with major impacts on the transport of consumables and intermediate goods.

The products categories driving this revolution are time-sensitive products, with pharmaceuticals and medicines being just one example.

The Defence industry is usually strongly affected by the trend in military spending by the United States and the NATO countries in general.

The strategy adopted by the US administration in the last four years was one of bilateralism in its international relations; in its transatlantic relations, strong pressure was placed on other member countries to increase their military spending.

In general, the persistence of geopolitical tension and a focus on security issues has contributed to sustaining government spending in the military field.

Global defence spending is predicted to grow at a CAGR of around 3% until 2023, to approximately USD2.1 trillion3.

A&D turnover in the United States is almost USD500 billion, and the industry directly employs some 900 thousand people4.

The OEMs continued to consolidate and pursue efficiency via economies of scale in their production chains. This is reflected in the particularly intense M&A activity of recent years underpinning the steady vertical integration5.

The Italian companies operating in this industry are some OEMs or systems suppliers, and a supply chain of SMEs which play a strategic role and which have, over time, cultivated partnerships with major, particularly US, industry players.

The Italian A&D industry is prominent in the international stage: it ranks fourth in Europe and seventh globally, with around 50 thousand direct employees and turnover approximating €15.5 billion, including €8 billion for exports6.

Despite the US administration’s dismantling of free trade agreements, the aerospace sector is still regulated by a plurilateral agreement (the Agreement on Trade in Civil Aircraft) eliminating import duties on sales of civil aircraft and their parts and components, which survived the US-EU trade wars over the issue of government subsidies.

Boeing, Commercial Market Outlook 2020 – 2039, October 2020. ↩

Boeing CMO, op.cit. ↩

Deloitte. “2020 Global Aerospace and Defense industry outlook”. ↩

American Chamber of Commerce in Italy, “La centralità della Relazione Transatlantica tra Italia e Stati Uniti”, November 2020. ↩

The average enterprise value of industry companies also increased over the past three years from 9.9 (2015) to 14.2 (2018). ↩

AIAD (Federazione Aziende Italiane per l’Aerospazio, la Difesa e la Sicurezza; the Italian Federation for Aerospace, Defence and Security figures), quoted in the American Chamber of Commerce in Italy, op.cit. ↩

![MAG Annual Report 2020 [EN]](https://finance.mecaer.com/2020en/wp-content/uploads/sites/10/2021/02/MAG2020.png)