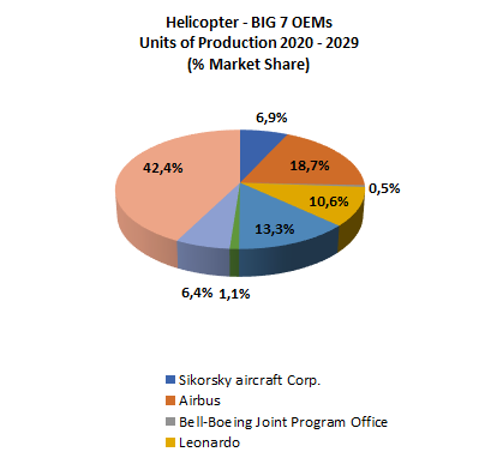

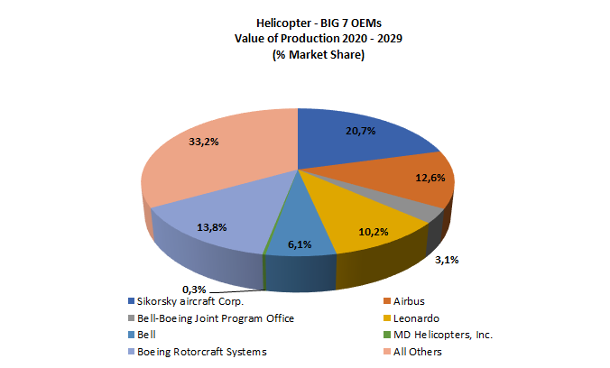

The helicopter industry is worth approximately USD2141 billion on a ten-year basis and consists of a limited number of manufacturers (OEMs), five of which cover roughly 56% of the market in terms of the number of aircraft and 67% in terms of revenue (Sikorsky Aircraft, Airbus Helicopters, Bell Helicopter Textron, Leonardo Helicopter Division and Boeing Rotorcraft Systems). Including the share held by the Russian Federation’s Russian Helicopters, it accounts for almost 70% of the number of aircraft and over 80% of revenue.

The 2015 – 17 period marked an unprecedented downturn in the civil helicopter sector, recording a low in 2016 before experiencing a sharp upswing in the next three-year period.

While 2020 is another challenging time, the sector has mainly been affected by production issues related to the scaling back or closure of production units during the lockdown period, and not much in terms of backlog.

Although uncertainty persists, forecasts are for production and sales of new aircraft to recover in direct correlation to the improvement in the health crisis.

The forecast number of units and revenue for the next ten years for the entire helicopter industry is for just under 17 thousand aircraft.

| Helicopters (Big 7 OEMs) – Number of units and revenue in 2020-2029 | Units | Billions of USD |

|---|---|---|

| Sikorsky Aircraft Corp. | 1.154 | 44,4 |

| Airbus Helicopters | 3.122 | 27,0 |

| Bell-Boeing Joint Program Office | 86 | 6,7 |

| Leonardo – Helicopter Division | 1.775 | 21,7 |

| Bell Helicopter Textron | 2.217 | 13,2 |

| MD Helicopters | 178 | 0,6 |

| Boeing Rotorcraft Systems | 1.063 | 29,4 |

| Other | 7.072 | 70,9 |

| Total | 16.667 | 213,9 |

Market shares stabilised after the entrance of new OEMs from emerging economies, such as Russia and Korea, which led to a slight decrease in the share of western producers.

This situation is nevertheless expected to change in the near future as a result not only of the vigorous technological development of the emerging economies but also of the new aircraft developed for their domestic markets which has potential for expansion to other markets in an as-yet uncertain timeframe.

Airbus Helicopters2 continues to hold a dominant position among the main producers of the civil helicopter market, with an overall 54% market share, followed by Leonardo (23%) and Bell Helicopters (12%) [percentages are in terms of numbers of units produced].

The Franco-German group sold 336 aircraft in 2019 and has a very strong book-to-bill ratio, with 369 orders for new helicopters worth around €7.2 billion.

Leonardo increased its market share by two percentage points during 2019, obtaining orders worth €4.7 billion to take its backlog to an overall €12.6 billion3.

Sales of Leonardo’s helicopter division were strong in the first nine months of 20204, with an increase in the backlog related mostly to government contracts both in Europe (the AW101 for the UK Ministry of Defence, the AW169 for the Italian army and the NEES programme) and in the United States (first order of 32 TH-73A – AW119 helicopters for the US Navy).

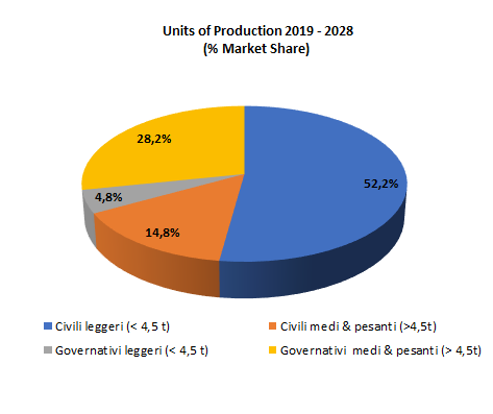

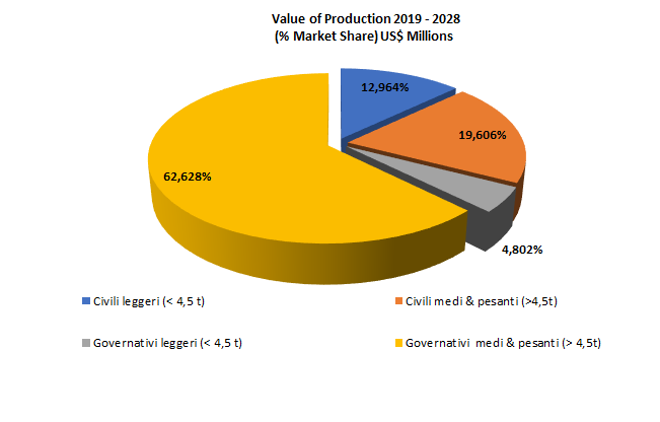

The market segmentation by helicopter category shows that civil aircraft will account for 67% of helicopter units and 33% of helicopter revenue over the next decade, while military aircraft for defence will account for 67% of revenue.

Forecasts point to a substantial stability in these percentages over the medium term.

| Helicopters – Number of units and revenue in 2020-20295 | Units | Billions of USD |

|---|---|---|

| Light civil helicopters (< 4,5 t) | 8.697 | 27,8 |

| Medium and heavy civil helicopters (>4,5 t) | 2.465 | 41,9 |

| Light military helicopters (< 4,5 t) | 798 | 10,3 |

| Medium and heavy military helicopters (>4,5 t) | 4.707 | 133,9 |

| Total | 16.667 | 213,9 |

The most numerically significant segment is that of light civil helicopters, with a maximum take-off weight under 6,600 kg (15,000 pounds). Production in this sector has stabilised over recent years, rising from 842 units in 2016 to 994 in 2018 and just under 900 in 2019.

The health crisis has undoubtedly pushed down estimates, with several projections currently predicting that volumes will return to pre-crisis volumes of around 800 units per year in 2022.

Medium-term forecasts6, conversely, are for production levels to remain steady, returning to over 1,000 units as from 2025.

The market segmentation for these helicopters is usually broken down into the following main sectors: emergency medical services (EMS), utility operators, corporate/VIP users, law enforcement and the energy industry (Oil & Gas).

Indeed, this aircraft type is comprised of the most versatile machines available, with uses ranging from passenger or cargo transport from airport to airport to various utility missions, in agriculture, for aerial photos and video and observation.

Each of these sectors will influence the composition of the backlogs of the manufacturers based on the budgets of the public administrations or private companies, some of which, such as Oil&Gas companies, are still under pressure due to internal market dynamics.

Corporate/utility operators make up the majority of the market that analysts7 predict will continue to represent some 30% of the demand for light civil helicopters in the next five years.

A new Light/Medium class has in fact emerged within the medium-heavy helicopter segment. It is comprised of only a few, highly successful aircraft, dominated by Leonardo’s AW139 and the Airbus H145.

As regards the other OEMs, the Chinese company AVIC currently produces small numbers of H410s/H425s. The Indian company Hindustan Aeronautics Ltd has developed a 12-seater aircraft (“Dhruv”) mainly for the domestic market, as it seems to have given up on obtaining western certifications for the aircraft.

Russian Helicopters, on the other hand, has a civil aircraft range currently limited to a small number of models such as the Ka-226 and the Mi-34, but is working on a new single-engine, five-seater aircraft – the VRT-500 – which aims to obtain EASA certification to compete on western markets against models of the same weight category, such as the B505 or the Robinson R66. Turkish Aerospace Industries is working on a new, 12-seater twin-engine civil helicopter which aims to enter the segment of Leonardo’s AW139 and Airbus’ H160.

The Medium/Heavy civil aircraft segment with a maximum take-off weight of more than 6,800 kg (15,000 pounds) is a niche occupied by a relatively small number of models which, due to their features and size, are mainly used in the Oil&Gas sector or for SAR activities and VIP transport.

Its trend is, therefore, highly dependent on that of the energy industry and its demand for logistics support to and from their production sites.

Sikorsky (S-92), Airbus Helicopters (H225) and Russian Helicopters (Mil Mi-8/17) have traditionally been significant players in this segment. Although contingent on the situation of the Oil&Gas market, Leonardo’s AW139 helicopter is experiencing success, and the Leonardo AW 609 may also position itself in this segment once certified.

The short-term sales outlook is inevitably linked to the economic context, however, the available observations tend to confirm the growth outlook predicted by analysts.

Production in the medium to long-term is estimated at around 200 aircraft annually.

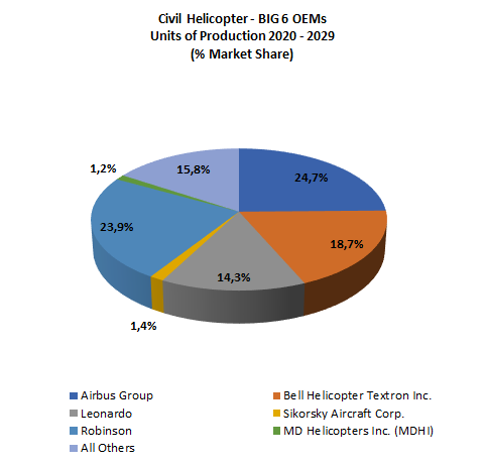

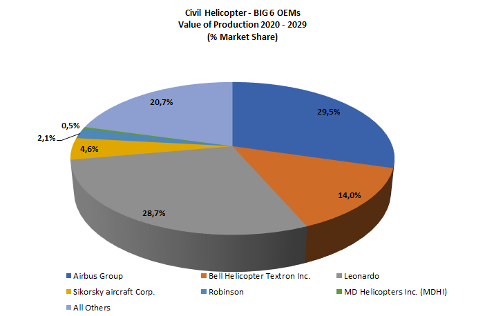

In terms of market share, the civil helicopter market is forecast to maintain its strong concentration, with the top three manufacturers – Airbus Helicopters, Bell Helicopter Textron and Leonardo – accounting for over 57% of demand for new aircraft in the next ten years, and over 72% in terms of revenue.

| Civil helicopters – Number of units and revenue in 2020-20298 | Units | Billions of USD |

|---|---|---|

| Airbus Helicopters | 2.762 | 20,6 |

| Bell Helicopter Textron | 2.086 | 9,7 |

| Leonardo – Helicopter Division | 1.598 | 20,0 |

| Sikorsky Aircraft | 156 | 3,2 |

| Robinson | 2.671 | 1,5 |

| MD Helicopters (MDHI) | 129 | 0,3 |

| Other | 1.760 | 14,4 |

| Total | 11.162 | 69,7 |

Long-term growth is linked to both demand, which is growing particularly strongly in the emerging areas of the globe, partly as a result of the many uses in areas lacking infrastructure, and to technological development and the introduction of new, higher-performing models offering lower fuel consumption and improved comfort.

The civil, light and medium helicopter segment, which is also the most competitive, constitutes the main market for MAG Group’s products and services, especially for the consolidated operating segments (see Errore. L’origine riferimento non è stata trovata.).

The investments made during the more than 20 years of MAG Group’s history have mainly been aimed at commercial diversification, pursuing an increasingly balanced position vis-à-vis the various aircraft manufacturers.

The MAG Group is present with its products in all main civil helicopter projects (AW109, AW119, AW139, AW169, AW189, B505, B429, B525, AH145 and AH160), with landing systems, flight controls hydraulics and interiors, depending on the case.

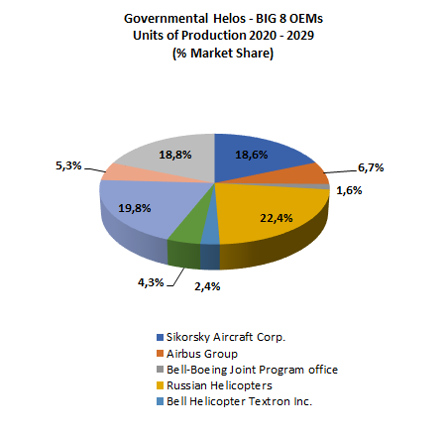

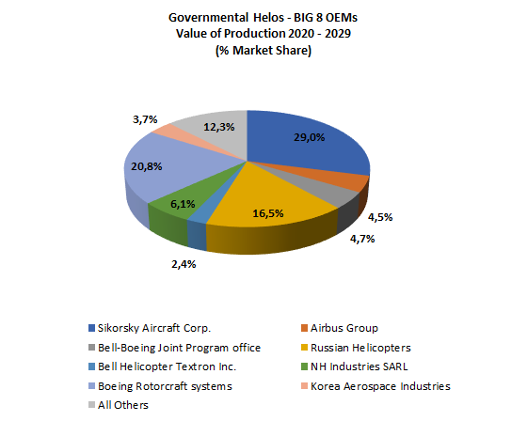

With respect to the military sector, after a decline that commenced in 2012, the light and medium aircraft segment recovered as from 2016, to then stabilise. The outlook for the next ten years is positive, thanks to the effects of the stance of public administrations, starting with the US, which have to date accrued defence budgets.

In terms of production, the new programmes will be variations of civil models, such as Airbus Helicopters’ H160M or Leonardo’s TH119 and MH139.

| Military helicopters – Number of units and revenue in 2020-2029 (top eight OEMs)9 | Units | Billions of USD |

|---|---|---|

| Sikorsky Aircraft | 998 | 41,2 |

| Airbus Helicopters | 360 | 6,4 |

| Bell-Boeing Joint Program office | 86 | 6,7 |

| Russian Helicopters | 1.205 | 23,5 |

| Bell Helicopter Textron | 131 | 3,4 |

| NH Industries | 230 | 8,7 |

| Boeing Rotorcraft Systems | 1.063 | 29,5 |

| Korean Aerospace Industries | 287 | 5,2 |

| Other | 1.008 | 17,4 |

| Total | 5.368 | 141,9 |

The medium-heavy helicopter segment experienced a protracted period of growth of some ten years, followed by a contraction in production from 712 units in 2013 to 418 in 2018.

The completion of the upgrade of the military fleets in the major areas (North America and Europe) contributed to this trend in this helicopter sector.

This process has a long tail which analysts forecast will see a gradual decline in orders from the main NATO countries.

The largest market for this type of aircraft in terms of numbers is North America, followed by Asia and Europe, which are projected to account for a greater share.

This segment includes almost all the leading manufacturers with important aircraft: Leonardo with the AW101 and the CH47, manufactured in partnership with Boeing (the latter, in partnership with Bell, is present with the V-22, a convertiplane manufactured for the Marines and the US military forces), Airbus Helicopters with the AH/EC725 and Sikorsky with the Black Hawk H-60 series.

In the 2020 – 2029 period, Russian Helicopters is projected to become the leader of this segment in terms of units produced, while Sikorsky (Lockheed Martin) should continue to rank first in terms of revenue.

This ranking of the Russian manufacturer is based on its a-27, Ka-31 (maritime), Ka-52, Mi-28 and Mi-35M (attack), Mi-17, Mi-26 and Mi-38 (transport) models.

Sikorsky’s leadership is mainly underpinned by aircraft from the H-60 (Black Hawk and Seahawk) family. The OEM is also developing a new version of the CH-53 for the US Navy and the VH-92 variation of the S-92 civil helicopter as a passenger transport aircraft for the president of the United States.

The presence of OEMs from emerging countries, such as Korean Aerospace Industries (KAI), is increasingly strong and is changing the market share distribution.

The effect that the Future Vertical Lift programmes launched by the US Department of Defense will have remains to be seen, particularly in respect of the timeframes for their entrance into service.

MAG Group’s inclusion in military development projects has traditionally been limited to providing components or systems for variations of civil models, and continues to accounts for a small market share today (approximately 2% of the total). The group subsequently acquired programmes such as the Korean Utility Helicopter, built by KAI, with production beginning in 2012, with approximately 260 helicopters expected to be built and for which MAG will supply the set of flight controls for the Surion aircraft.

More recently, the MAG Group was selected for a series of partnerships with Bell Textron for the landing gear for programmes for the US Department of Defense, including the V247 aircraft and the Future Attack Reconnaissance Aircraft (FARA) programme. The prototyping stage of the final process of assigning the contract is currently underway.

Interest is also strong in the potential participation in the V280 programme.

Forecast International. “The market for Light Military Rotorcraft”, “The Market for Medium Heavy Military Rotorcraft”, “The Market for Light Commercial Rotorcraft”, “The Market for Medium Heavy Commercial Rotorcraft”, 2020 Editions (October, November). ↩

Airbus Helicopters Results 2019, January 2020. ↩

Leonardo, 2019 Annual report. ↩

Leonardo, Results at 30.09.2020 ↩

Forecast International. “The Market for Light Commercial – Rotorcraft”

November 2020 and “The Market for Medium-Heavy Commercial – Rotorcraft” October 2020. ↩ Honeywell, annual “Turbine-Powered Civil Helicopter Purchase Outlook”, 2019. ↩

Source: Forecast International, “The Market for Light Commercial – Rotorcraft. Analysis 3”,op.cit. ↩

orecast International. “The Market for Light Commercial Rotorcraft” and “The market for Medium Heavy Commercial Rotorcraft”, op.cit. ↩

Forecast International, “The Market for Light Military – Rotorcraft”, November 2019 and “The Market for Medium-Heavy Military – Rotorcraft”. March 2019. ↩

![MAG Annual Report 2020 [EN]](https://finance.mecaer.com/2020en/wp-content/uploads/sites/10/2021/02/MAG2020.png)