Potential remains high for the entire production and sales sector for commercial aircraft, in line with the very robust growth trajectory of the last few decades1, although the overall backlog is lower than its peak in 2018.

Over the last ten years, the industry’s average compound annual growth rate (CAGR) exceeded 7%, outperforming that of the market.

The short-term outlook is affected by the issues with some aircraft, mainly the A380 and the B737 Max, which separately impacted the two main manufacturers, followed by the impacts of the epidemic on transport, airlines and, therefore, orders.

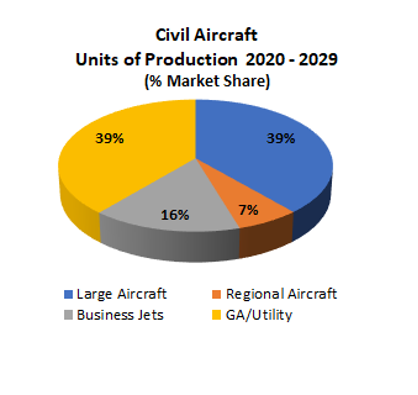

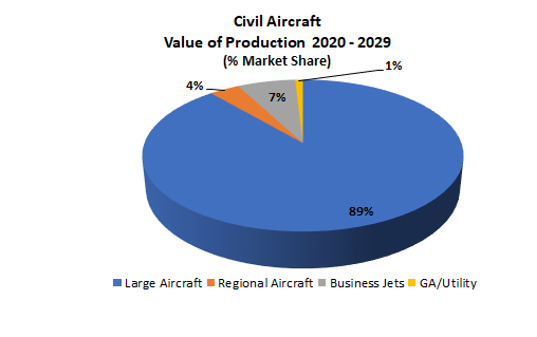

Civil aircraft market forecasts for 2020-2029, including business jets, are for over USD3 billion and just under 45 thousand aircraft.

| Regional aircraft | 2.994 | 112,3 |

| Business jet | 7.033 | 217,3 |

| GA/utility | 17.259 | 28,8 |

| Total | 44.441 | 3.171,6 |

The regional market is particularly concentrated in expansive territories such as North America, where airlines offer high frequency flights and connectivity for business travellers on routes that would be inefficient for larger aircraft.

Regional carriers are the only means of air transport available in more than half the US airports and represent 40% of all passenger traffic in the United States2.

Despite the stagnation in demand, the business jets market has performed steadily over recent years thanks to the new models deployed and to the OEMs’ good penetration in key markets.

The book-to-bill ratio remained virtually unchanged for the main aircraft manufacturers in the two years prior to the health crisis, while the FAA’s introduction of new regulatory requirements, such as the ADS-B, encouraged the upgrade and overhaul of the existing fleets.

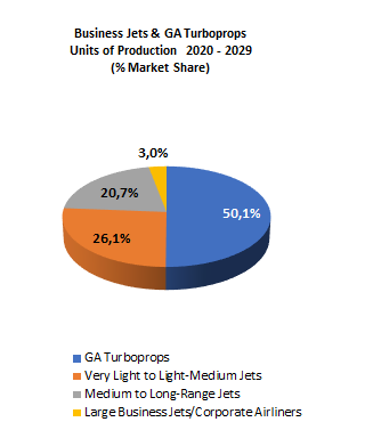

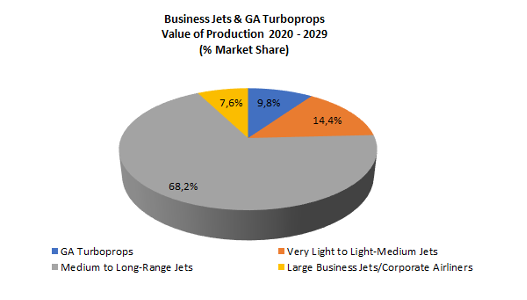

| Business Jets and GA turboprops – Number of units and revenue in 2020-20293 | Units | Billions of USD |

|---|---|---|

| GA Turboprop (excluded pistons) | 5.871 | 20,2 |

| Very Light to Light-Medium Jets | 3.063 | 29,9 |

| Medium to Long-Range Jets | 2.431 | 141,1 |

| Large Jets/Corporate Airliners | 352 | 15,8 |

| Total | 11.717 | 207 |

The production of business jets, one of MAG Group’s fixed-wing segments, recorded its first year of growth since 2014 in 2019, with a 12% increase over the previous year.

The increase was significant as it was seen across both long-range aircraft, as well as small and medium, indicating an inversion of the decreasing tendency experienced since 2013.

The disruption caused by the health emergency largely halted air transport in spring 2020, more strongly in the case of public transport. Business travel worldwide posted an overall 37% drop in the first half of 2020 compared to the corresponding period of 2019. The easing of restrictions went hand in hand with a recovery in activity as early as summer, although effects on revenue are expected to be seen in 2020 and 2021, particularly in the supply chain.

Even in this segment, the fundamentals remain positive4, with the forecast production of 540 aircraft in 2020, rising to over 800 units per year within a decade. The same goes for revenue which, from the nearly USD17 billion predicted for the current year, should rise to USD27 billion by 2030.

The top producers remain Cessna, Bombardier, Gulfstream, Embraer, Dassault and Honda.

The overall forecast for the production of business jets for the next decade exceeds 7 thousand new aircraft for an amount of USD217 billion.

Gulfstream continues to rank second after Cessna among the leading aircraft manufacturers, with a forecast 1,831 aircraft in 2020-2029 and a 26% market share.

Incidentally, Gulfstream ranks first in terms of value, with revenue of around €78.7 billion and a 36.2% market share.

Gulfstream has launched several new projects, such as the G500 and G600, in recent years: these aircraft are in the Bombardier Challenger 650, Cessna Longitude and Dassault Falcon 8X segments, characterised by technological innovation and design.

This segment, which covers the entire range of Gulfstream aircraft, corresponding to the very light jet and long-range segment, is a market for MAG’s products.

Smaller business jets, also known as personal or entry-level jets, are aircraft that carry up to eight passengers, with a maximum take-off weight of 5,000 kilograms, and are single-pilot certified.

Customers of this market include private owners, small corporations, charter companies and pilot schools. In the early 2000s, this segment received a boost from the air-taxi companies which offered a large number of these aircraft for point-to-point transport between small airports. However, the 2007/08 financial crisis impacted this operating model greatly, quashing initial growth expectations.

The most numerous models on the market are currently the Phenom 100EV and the Hondajet Elite produced by the Honda Aircraft Company, a US subsidiary of the Japanese Honda Motor Company.

The Elite is an upgrade of the earlier Hondajet. It carries four passengers and has a range of 1,437 nautical miles.

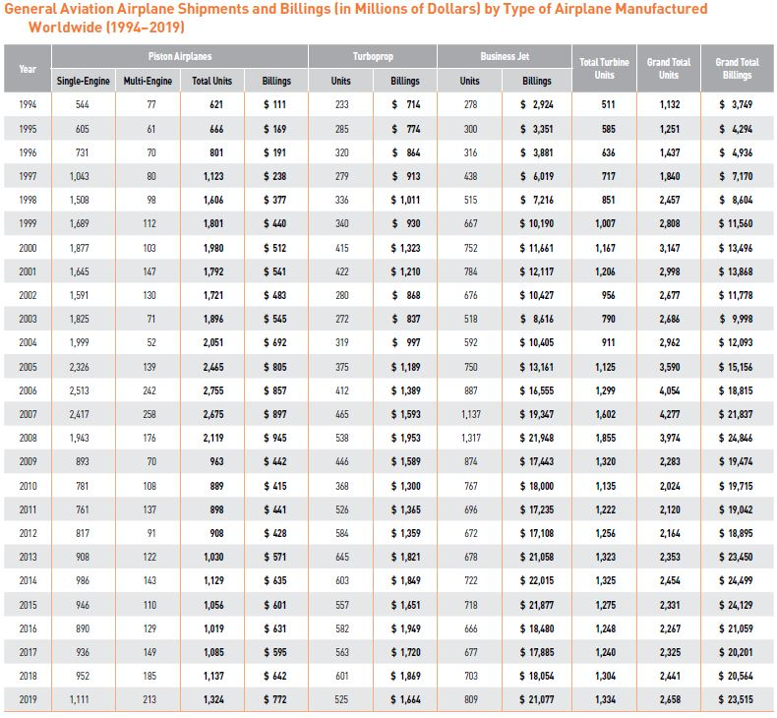

GAMA historical figures confirm the segment trends and dynamics of the last seven years, with 2019 representing something of a turning point in the trend of the reference market.

In terms of the geographical distribution, a hefty 65% of the market is accounted for by North America, more than 15% by Europe and the remainder by Asia (around 10%), Latin America (around 6%) and Africa-Middle East (around 4%).

Studies indicate that the technologically advanced new models that have entered service, such as the Gulfstream G500 or the Bombardier Global 7500, will stimulate demand. Further afield, the most interesting development frontier is urban aerial mobility, comprising a vast range of air transport solutions which include UAV systems with hybrid or electric engines and little to no emissions.

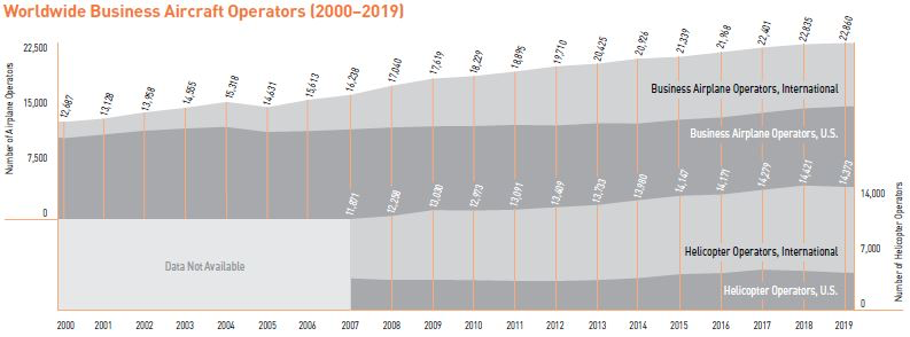

We have seen in the past how the diversification of private transport services offered using business jets, such as fractional ownership, air charters or jet cards, services provided by specialised companies, spurred the growth of the sector.

While operators grew in number and expanded their fleets, fractional ownerships coalesced around more modest figures after the growth trend fizzled out in the first decade of the 2000s.

The following graph, based on GAMA6 figures for 2020, compares the number of operators in the similar markets of business jet and helicopters.

In the next few years, certain aspects of the applicable regulations, particularly in terms of emissions and the ETS system, could cause market changes with an impact on operators’ management costs and, potentially, providing an impetus to renew existing fleets.

The average increase was more than 120% over the last twenty years using a seven-year moving average. DTTL. “2018 Global Aerospace and Defense Industry Outlook”. ↩

Embraer Market Outlook 2019 – 2039. ↩

Forecast International.“The Market for Business Jet Aircraft”, October 2020. ↩

The information in this section is taken from Forecast international. “The Market for Business Jet Aircraft”, November 2020. ↩

General Aviation Manufacturers Association (“GAMA”). 2019 Annual Report, March 2020, Fig. 1.1, p. 9. ↩

GAMA, 2019 Databook, March, 2020.GAMA, 2019 Databook, March, 2020. ↩

![MAG Annual Report 2020 [EN]](https://finance.mecaer.com/2020en/wp-content/uploads/sites/10/2021/02/MAG2020.png)