GDP contracted by 13% in the second quarter of 2020, the quarter hit the hardest by the crisis, while the bounce-back of the third quarter was larger than expected at around 12%.

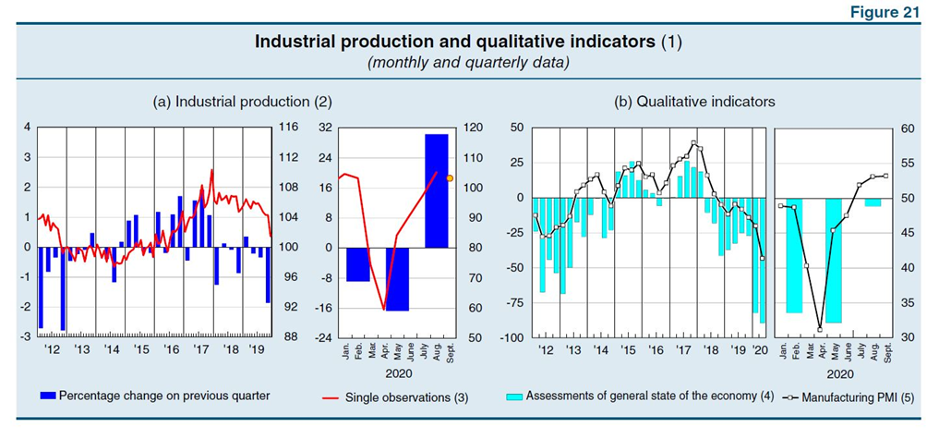

This mini-recovery was fully driven by industrial production, which grew around 30% in the third quarter, when all sectors were able to resume operations.

All the real-time indicators, from electricity consumption to gas distributed to the industrial sector to motorway traffic, returned to pre-Covid levels.

As well as being reassuring, this phenomenon has also provided a view of how the various economic sectors contribute to Italian GDP, which should be taken into consideration in deciding economic policies and intervention priorities1.

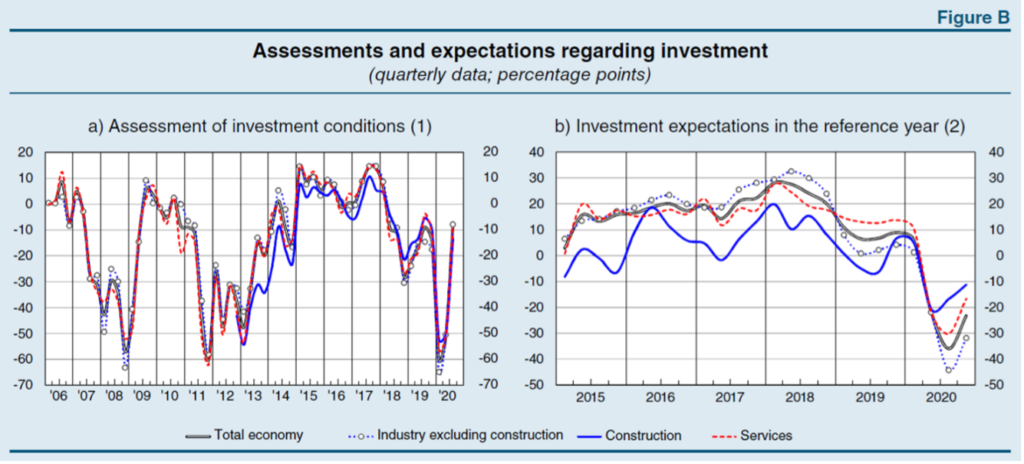

Companies’ assessments of investments conditions give an idea of the outlook, with surveys carried out on the opinion on the general economic situation by well-regarded bodies2 indicating an improvement.

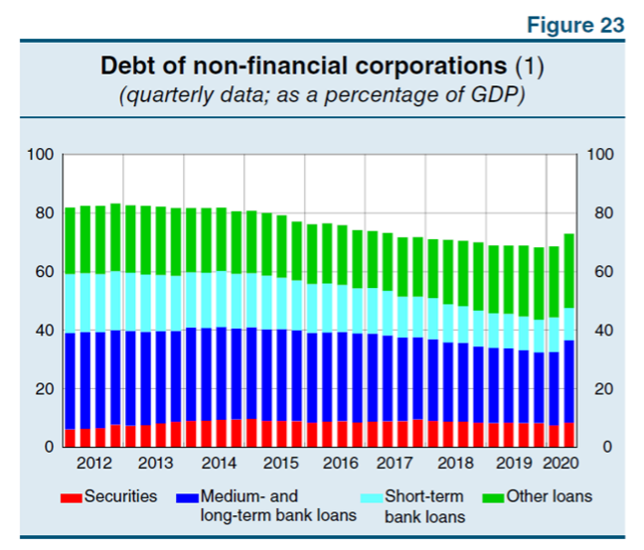

In this phase, Italian companies’ self-financing capacity (the ratio of gross operating surplus to value added) decreased and total corporate debt as a percentage of GDP rose slightly. However, it should be noted that the debt of Italian companies is still well below the European average of some 115%.

This is consistent with macroeconomic data which ranks Italy as one of the countries – including European countries – with the lowest ratio of gross public debt to GDP, including net private household and business savings, which is more than four times the public debt.

The Bank of Italy graph shows the ratio between income, comprised of the cumulative flows of the last 4 quarters, and end-of-quarter stocks for debt, including securitised loans.

Following the public health emergency, the share of debt issued by the most risky companies increased slightly, cushioned by the support measures introduced to date.

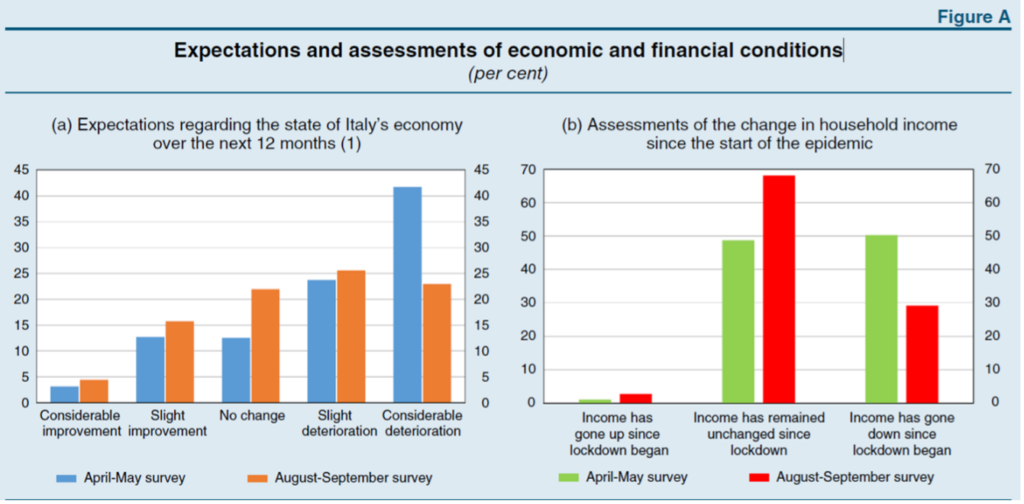

The financial situation of households during the pandemic, measured via the Bank of Italy’s Special Survey of Italian Households (Indagine Straordinaria sulle famiglie italiane; ISF)3, has shown a clear improvement in recent months, with less than 30% of those surveyed stating that their income had decreased since the beginning of the health emergency, mostly in those where the heads of household are self-employed or work in sectors hit hard by the situation.

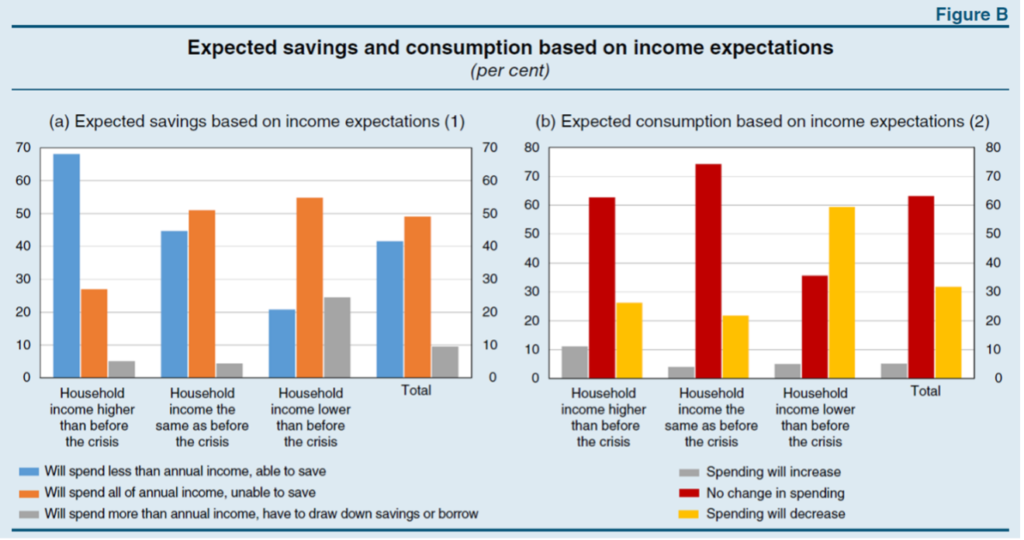

With more than 40% of households expecting to spend less of their annual income in the next twelve months, the propensity to save of Italian households remains high. The survey sample comprised 70% of households that expect their income to increase over the same period as well as 20% that expect a decrease.

Naturally, there is a change in consumption patterns, with households tending to prioritise spending on medicines and essential goods, such as food, over non-essential expenses such as hotels, coffee bars and restaurants.

![MAG Annual Report 2020 [EN]](https://finance.mecaer.com/2020en/wp-content/uploads/sites/10/2021/02/MAG2020.png)