The scenarios are largely shaped by projections as to the depth of the 2020 recession and expectations for a recovery in 2021.

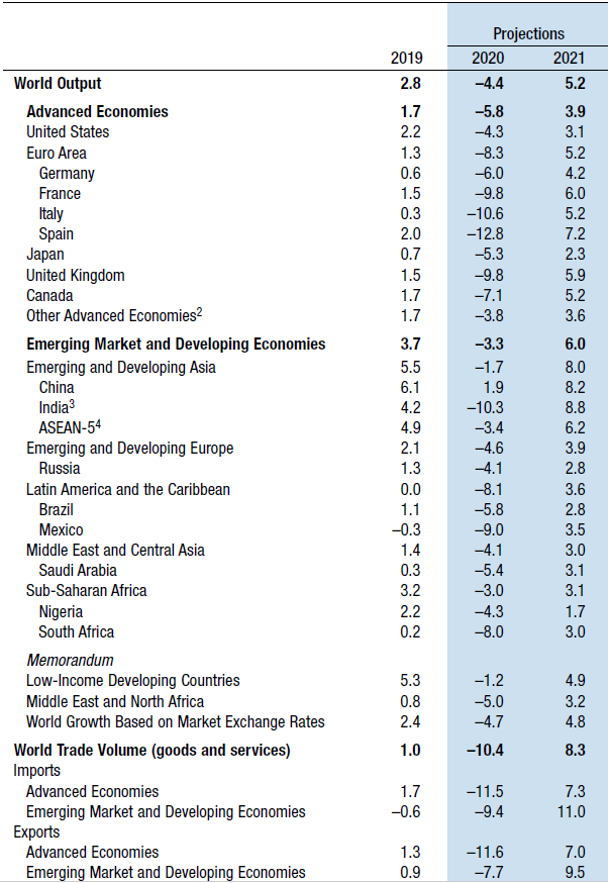

The most recent estimates put the contraction in the global economy at around 4.4% for 2020, projecting a rebound of over 5% in the coming year.

Naturally, these estimates are based on current expectations of a gradual but steady easing of the health crisis and they reflect the greater optimism at the present time, due to the better-than-expected third quarter figures.

In November, we also received the positive results of the Sars-CoV-2 vaccines at an advanced stage of testing, some of which were undergoing the approval stage by the US Food & Drug Administration in December.

The timeframes needed to return the health situation to normal will affect the trend of the global economy in the months and years to come. The scenarios prepared by analysts and international bodies provide an idea of how this will occur and differences between the various areas of the globe.

What we find consistently throughout these projections1 are growth rates higher than those pre-Covid, particularly in the advanced economies that were already on the road to recovery.

The year-on-year percentage change shows greater contractions for 2020 in those countries hardest hit by the health crisis, namely Italy, Spain and France in Europe, India in the Asian region, and Mexico and Brazil in Latin America.

The drop in international trade reflects the logistical challenges and difficulties of some commodities markets.

Forecasts for beyond 2021 are currently for global growth to slow to about 3.5% on an annual basis in the medium term, before returning to the economic growth curve for 2020-2025 forecast before the health crisis.

The growth scenarios are currently linked to the increase in sovereign debt stocks during the initial stage of rolling out the economic support measures, which is around 20% in the advanced economies2.

![MAG Annual Report 2020 [EN]](https://finance.mecaer.com/2020en/wp-content/uploads/sites/10/2021/02/MAG2020.png)