The internal control system is comprised of a series of rules, procedures and organisational structures aimed at ensuring compliance with group strategies and the achievement of the following objectives:

- the effectiveness and efficiency of internal processes,

- safeguarding the value of assets and protection against losses,

- the reliability and integrity of financial information;

- compliance with applicable legislation, plans and internal procedures.

As part of its management and coordination activities, MAG:

- checks the strategic development of the various areas in which the group operates (see STRATEGIES AND STRATEGIC POSITIONING);

- conducts a management control to ensure that balance is maintained, particularly with respect to the profitability indicators and the financial balance of both the individual companies and the group as a whole (see GROUP PERFORMANCE);

- performs an operating check to evaluate each entity’s different risk profile through risk management activities(see RISK MANAGEMENT AND COMPLIANCE).

In compliance with the provisions of the Code of conduct on which the parent has based its policies, the administrative and control model is integrated with:

- committees set up within the board of directors upon renewal of the company bodies, with responsibility for making proposals and recommendations on specific issues without decision-making power, such as the strategic committee and the appointment and remuneration committee:

- the role of Chief Risk Officer, conferred on one of the two deputy chairs and responsible for “risk management”, “internal control coordination” and “corporate secretary” duties.

Finally, the group’s administrative and control model includes the Supervisory Body, which was set up following the group’s adoption of the organisational and management model pursuant to Legislative decree no. 231/2001, whose functions, since 25 March 2013, are entrusted to the board of statutory auditors, as permitted by Law no. 183/2011.

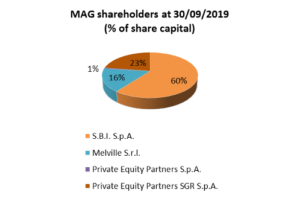

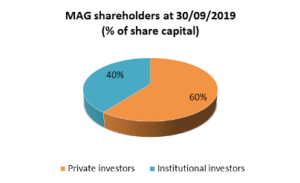

SHAREHOLDERS

MAG’s shares are owned by private and institutional investors at 30 September 2019, as shown in the table below.

| Number of shares | Investment | |

|---|---|---|

| S.B.I. S.p.A. | 7.931.242 | 60,37% |

| Melville S.r.l. | 2.157.345" | 16,42% |

| Private Equity Partners S.p.A. | 91.481 | 0,70% |

| Private Equity Partners SGR S.p.A. | 2.957.932 | 22,51% |

| "Total" | 13.138.000 | 100,00% |

There were no other changes in the ownership structure in 2018/19 or after the reporting date.

The by-laws set certain limitations on the transfer of shares, specifically pre-emption rights – in favour of shareholders – and approval – of new shareholders.

There are no securities granting special rights, or restrictions on voting rights. The by-laws do not provide for shares with multiple or increased voting rights.

THE BOARD OF DIRECTORS

The current board of directors was appointed on 29 December 2018 in its present configuration of five members and will remain in office until the approval of the separate financial statements as at and for the year ending 30 September 2021. Before the appointment of this board, the board of directors was comprised of six members, the position of chairman was separate to that of the managing director and this latter position was held by an executive1 of the parent who also held the position of CEO.

The board of directors met nine times in 2018/19 and was fully attended.

The statutory auditors attended the meetings and the manager in charge of financial reporting attended those meetings for the examination and/or discussion of issues of an accounting or financial nature. On occasion, certain MAG managers were invited by the chairman to report on specific issues on the agenda.

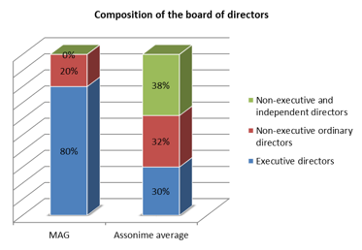

| POSITION | MEMBER | TYPE |

| Chairman and managing director | Bruno Spagnolini | executive |

| Deputy chairman | Corrado Monti | executive |

| Deputy chairman | Valter Pasqua | executive |

| Director | Lorenzo Caporaletti | non-executive |

| Directgor | Emanuele Vignoli | non-executive |

No powers have been conferred on the board of directors for capital increases, or authorisations to repurchase treasury shares.

The by-laws require qualified majorities for resolutions concerning specific issues, such as non-recurring transactions, the approval of planning documents, the pledging of group assets as guarantees, the taking on and granting of non-current loans and sales deeds for group assets.

The parent has not formally adopted diversity policies in relation to the composition of its board of directors, as its selection and appointment criteria for the directors, based on voting lists2, are informed exclusively by requirements of professionalism and experience in the group’s sectors, in an independent manner and free of considerations of gender, age, social identity, ethnicity or language. These criteria do not require formulation as they correspond to a specific cultural orientation and are of a substantial nature.

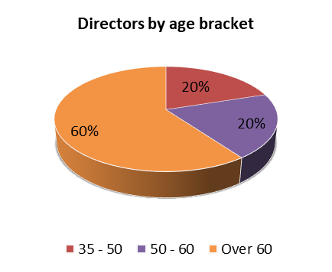

The board of directors has carried out an assessment of the adequacy of its own and its committees’ size, composition and functioning, which showed that:

- the board of directors’ size (five members, falling within the by-laws’ provision requiring from five to nine members) is adequate, considering the business size and type;

- considering that the board of directors comprises three executive directors experienced in business management and two non-executive directors with different expertise, its composition is adequate;

- the board’s and its committees’ functioning, as shown in the tables, is consistent with the parent’s size and type of activities and with the powers assigned to the chairman and managing director.

The chairman also holds the position of managing director, as he is a central figure and reference point for the parent and the group. As such, he has been conferred managerial powers and has ultimate responsibility for the corporate strategies. He does not own shares in the company.

During the year, he ensured that all board members – including non-executive – were in a position to take part in the discussion of topics specific to the parent’s sector with adequate knowledge of the matters, the legal context in which the group operates and the group dynamics.

To this end, the issues put to the examination and discussion of the board were accompanied by reports prepared by the chairman, which are made available to the board members before the date of the meetings. The chairman may invite managers to board meetings depending on the specific topics and matters on the agenda, in order to enhance the meetings.

THE STRATEGIC COMMITTEE

The role of the strategic committee is to make proposals and recommendations. It did not meet during the year due to the transitional phase underway since the shareholders appointed a completely new board of directors on 29 December 2018 comprised of a different number of board members.

| MEMBER | TYPE |

| Bruni Spagnolini | executive |

| Corrado Monti | executive |

| Valter Pasqua | executive |

The strategic committee is chaired by the chairman and managing director and is composed of the other two executive directors, who hold the position of deputy chairmen.

Its role is to examine and discuss the topics delegated by the board of directors:

- assist the chairman and managing director in identifying the guidelines for the medium-term budget/plan and the annual budget, which will then be submitted for the definitive approval of the board of directors;

- prepare development projects for new market penetration and the pursuit of strategic opportunities;

- approve binding bids for long-term contracts relating to development projects worth over €40 million in total;

- approve fast-track investments in property, plant and equipment and intangible assets entailing changes in the approved budget with subsequent reporting to the board of directors and approval of the purchase agreements for goods and services exceeding budget figures by over €100 thousand;

- approve the system risk monitoring plan and check that preventive measures and planned corrective actions are implemented.

This committee is in place and was set up within the board of directors for a useful and necessary purpose, i.e., to create a structured, organic process for the definition of the business mission and to encourage the implementation of the principles and values embodied in its business model in the strategic plan (see Errore. L’origine riferimento non è stata trovata.).

Having a body that liaises with group management increases the opportunities to report the repercussions that the main strategic decisions have on relationships with stakeholders. For MAG, strategic and business plans represent a guide, but also a tool for communicating with stakeholders.

THE APPOINTMENT AND REMUNERATION COMMITTEE

The appointment and remuneration committee is responsible for making proposals to the board of directors for the determination of directors’ fees and the identification of general remuneration criteria for top management of the parent and the group.

The committee provides the shareholders with information to determine the total fees due to the members of the various group companies’ boards of directors.

The committee also:

- proposes to the board of directors, if it so requests, candidates for director in the circumstances covered by article 2386.1 of the Italian Civil Code, if an independent director must be replaced;

- evaluates, upon the specific request of the shareholders which intend to submit lists for the appointment of directors, the independence of candidates for the office of director to be proposed at the shareholders’ meeting;

- carries out preliminary work to enable the board of directors to more efficiently carry out the annual evaluation of its own size, composition and functioning. To this end, it may express its opinion of the professionals it believes would be appropriate board members. To perform these duties, the committee may use the assistance of third party advisors.

The appointment and remuneration committee is comprised of three members, one of whom is non-executive and holds the position of chairman.

During the year, the committee met once, with full participation of all members.

| MEMBER | TYPE |

| Emanuele Vignoli – Chairman | non-executive |

| Corrado Monti | executive |

| Valter Pasqua | executive |

MANAGER IN CHARGE OF FINANCIAL REPORTING

In their extraordinary meeting of 21 September 2015, the shareholders amended the by-laws, introducing the role of manager in charge of financial reporting in accordance with Legislative decree no. 262/2005 and approving the related Regulation.

The by-laws amendment completes the voluntary adjustment of the company’s governance and alignment to the best practices applicable to companies whose shares are traded on regulated markets.

The manager in charge of financial reporting for the 2018/19 – 2020/21 three-year period was appointed with a resolution dated 29 December 2018.

THE BOARD OF STATUTORY AUDITORS

The board of statutory auditors was appointed on 29 December 2018 with the same composition as the previous three-year term. It will remain in office until the approval of the separate financial statements as at and for the year ending 30 September 2021.

| POSITION | MEMBER |

| Chairman | Rocco di Leo |

| Standing statutory auditor | Luisa Marzoli |

| Standing statutory auditor | Guido Riccardi |

| Standing statutory auditor | Daniela Caminiti |

| Standing statutory auditor | Giovanni Tedeschi |

During the year, the board of statutory auditors met four times. Average attendance of its members was 95%.

The statutory auditors’ duties extend past conducting checks and participating in periodic meetings required by law to their involvement in the meetings of the board of directors and the meetings held twice a year with the independent auditors.

Over the years, the board of statutory auditors has checked the suitability of Mecaer Aviation Group S.p.A.’s and its strategic subsidiaries’ organisational, administrative and accounting structures, with specific reference to internal controls, risk management and conflict of interest management. These assessments were based on information provided by and with the support of internal committees, with the assistance of the parent’s management.

As mentioned above, since 25 March 2013, the board of statutory auditors also performs the Supervisory Body’s duties, as provided for by the administrative and control model pursuant to Legislative decree no. 231/2001.

![MAG Annual Report 2019 [EN]](https://finance.mecaer.com/2019en/wp-content/uploads/sites/8/2020/06/Logo_up_big_2.png)