GENERAL DIRECTIVES. SHARED VALUE.

MAG’s strategy for the next five years is underpinned by the opportunities to grow and enhance the group offered by the foundations laid over the group’s recent history (see Errore. L’origine riferimento non è stata trovata.).

In both general and specific terms, it is based on the priority values identified over time and is oriented to the pursuit of continuous improvement, consolidating our strengths and reducing our limitations and weaknesses.

The multi-dimensional concept of a company having many stakeholders, described in an earlier part of this report on MAG’s business model, offers a view of strategy as a tool to enhance the business, while simultaneously remunerating and rewarding all stakeholders.

Of course, the driver remains making the most of its tangible and intangible assets, and achieving satisfactory profitability, with reference to performance standards underpinned by self-assessment and benchmarks.

MAG deems that these objectives are achievable through the implementation of an action plan focused on:

- its core business, which it has pinpointed for each operating segment (see Errore. L’origine riferimento non è stata trovata. and the notes to the consolidated financial statements, Errore. L’origine riferimento non è stata trovata. Errore. L’origine riferimento non è stata trovata.);

- strengthening its financial, human and intellectual capital and managing it with discipline;

- consolidating relationships with customers and retaining them;

- expanding its customer base in its market segment and consequently diversifying its portfolio and the related risks;

- projects of technical excellence, both in terms of applied research grants and the development of new products;

- projects to develop the brand and increase brand recognition;

- a strong connection with the local areas via dialogue and interaction with the community.

Consequently, the fundamental elements of this strategy consist of:

- consolidating MAG’s reputation as a reliable, quality industrial aerospace group with a solid range of products and services, an innovation incubator and a creator of value internally and for the local area;

- strengthening the group’s presence in its market segments, not only by growing in size but also by focusing on the essential processes of its core business, with the aim of acquiring a leadership position;

- increasing its diversification, with an increasingly international presence on the relevant advanced or emerging markets, by entering new geographical areas (Asia) and expanding its presence in the training equipment and business jet segments;

- strengthening its operating model, pursuing greater efficiency and process/structure integration. This scope also includes projects involving human resources, management incentives and striving to balance individual results with those of the entire group;

- optimising equity soundness, while maintaining a balance of sources and applications of funds, in order to strengthen capital, profits and cash flows.

Analysing MAG’s business model from a CSR and sustainability perspective enables the identification of the impact areas of the corporate strategies ( ) in the areas the group operates. These are represented in ISTAT’s map of sustainable development goals contained in its 2019 report.

The notion of the creation of shared value goes back to a concept written about by Michael Porter3 and one of his students at the Harvard Kennedy School, positing that an interpretation of the value chain model focused on maximising short-term profits had created the conditions for an unprecedented financial crisis in which an entire managerial class lost legitimacy.

However, the concepts of social responsibility that were retrieved could not remain marginal to organisations’ value chains and required a framework of guidelines formalising them.

Porter’s solution is a new way of achieving economic success, where company performance and the community intersect, acknowledging the transformational power of shared value

The main point of this approach has nothing to do with philanthropy or the redistribution of resources, rather, it is based on grasping the link between competitive advantages and CSR.

BUSINESS STRATEGIES AND POSITIONING. THE BUSINESS PLAN

MAG’s history has roots that reach back into the industrial experiences of SIAI, Agusta and Nardi, which are part of Italian aeronautical industry history.

MAG’s business project conceived in the mid-90s was a modern, contemporary reinterpretation of these models, creating and consolidating a purely industrial skill set focussed on components before developing a range of distinctive products (systems) and activities (services), putting itself forward to aircraft OEMs as a technologies and systems integrator.

This vision entailed significant investments in product innovation, initially as part of strategic partnerships (e.g., Claverham-FHL, Collins – United Technologies and Moog) and then individually, after consolidating skills and reputation.

During the ACCELERATED INNOVATION phase of its history (as defined in the section entitled Errore. L’origine riferimento non è stata trovata.), collaboration with universities and private research centres expanded beyond the need to complete new product development projects.

Innovation is a source of inspiration for MAG’s development as well as being a driver of growth in the unending pursuit of that difficult balance between the investment amount, financial capacity and factors, and opportunity (see Errore. L’origine riferimento non è stata trovata. and Errore. L’origine riferimento non è stata trovata.).

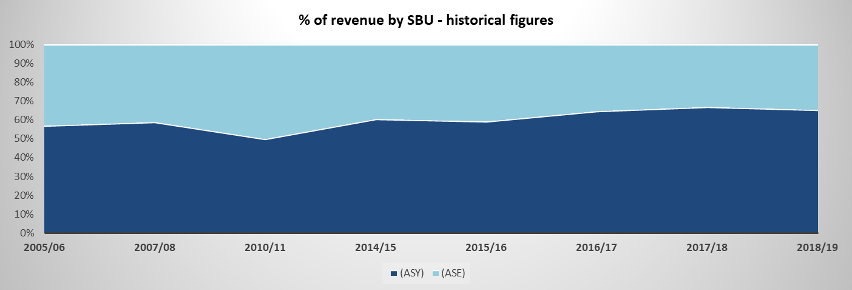

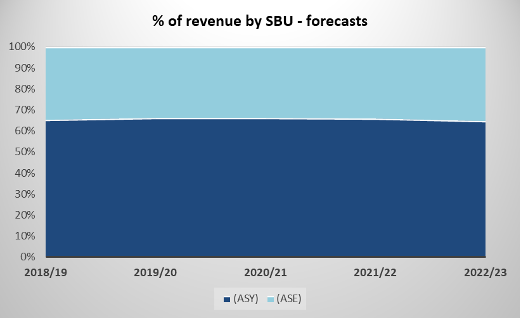

Analysing the stages of MAG’s development in terms of market penetration, the first period was limited to the helicopter market, both for technological systems (ASY) and for interiors and services (ASE). The landing gear for the Eclipse 500 and the A380 project were the first significant investments in the fixed-wing sector and the PORTFOLIO DIVERSIFICATION period saw the acquisition of contracts in the training aircraft, UAVs and business jet segments.

The sales policy pursued in order to achieve these objectives was based on cross selling strategies

- targeting OEMs that belong to the same group of companies as the customers it already serves,

- of other products and services in its range to existing customers.

From an organisational standpoint, MAG has over the years identified its strategic business areas – its operating segments – based on which the organisational decisions are made and operational and management tools deployed, from the identification of responsibilities to the objectives system, reporting processes and performance monitoring.

The first segment is the Aircraft Systems (ASY) segment, described earlier, which incorporates the whole range of safety-critical systems (landing systems, flight control systems, hydraulic systems, etc.).

The second segment – Aircraft Services (ASE) – incorporates the cabin interiors systems (Cabin Comfort Systems) and aircraft services (MRO, aircraft completion, refurbishment, etc.).

In the former, the driver of the potential size of these markets relates to the demand for new aircraft of the reference sectors, including that of the regional aircraft that MAG intends to penetrate in the near future. This sector is estimated at approximately USD80 billion, of which USD10 billion refers to commercial helicopters.

Percentage wise, the group’s systems account on average for 10% of the aircraft sale price, in addition to maintenance activities that may reach a further 15%.

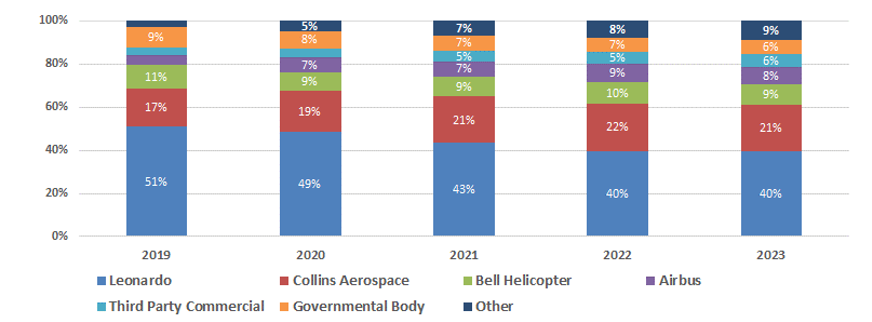

The percentage of revenue generated by the group’s key customer (Leonardo Group) contracted 15 percentage points from 75.5% to 60.5% in the 2014-2019 five-year period, while business plan projections forecast it will drop to below 50% as early as 2020.

The group’s growth process is therefore based on development objectives in accordance with defined priorities. These objectives are based on the essential elements underpinning its strategies. As such, its growth does not relate solely to volumes.

It includes a series of actions aimed at enhancing value, as defined in previous sections of this report (e.g., Errore. L’origine riferimento non è stata trovata.) and, accordingly, considering the perspective of the various stakeholders.

| Stakeholder | Type of capital | Objective |

|---|---|---|

| Workforce (employees and contractors) | Human and organisational | Employment, enhancement and atmosphere |

| Shareholders | Financial | Profitability, financial soundness |

| Customers | Commercial and relationships | Reputation, satisfaction |

| Suppliers | Commercial and relationships | Integration, quality |

| Financial community | Financial | Profitability, financial soundness |

| Public administration and institutions | Infrastructures and relationships | Consensus, distribution of wealth |

| Community and the local area | Natural and environmental | Innovation, reducing consumption |

| Technological community | Technological | Innovation, reducing consumption |

Many of the investments made, not only in technologies, although they are certainly the most voluminous, cannot yet be perceived in terms of current activities, but are an essential factor in consolidating MAG’s position and ensuring business continuity over time.

![MAG Annual Report 2019 [EN]](https://finance.mecaer.com/2019en/wp-content/uploads/sites/8/2020/06/Logo_up_big_2.png)