The most recent economic cycle is marked by fears of a slowdown in the global economy and international trade, against the backdrop of new concerns stemming from protectionist pressures and elements of uncertainty such as Brexit.

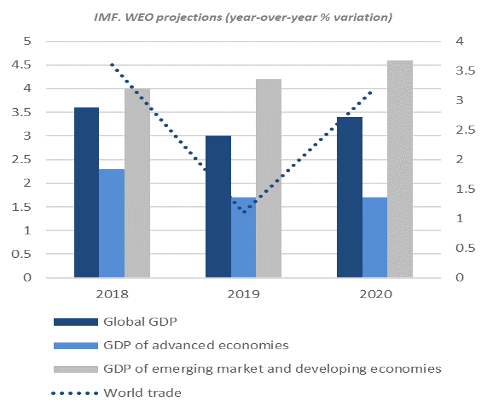

The slowdown is already statistically detectable and is considered to be “consistent” with the estimated growth of the global economy which has been revised downwards to 3% growth – year over year – an all-time low since the end of the last global financial crisis.

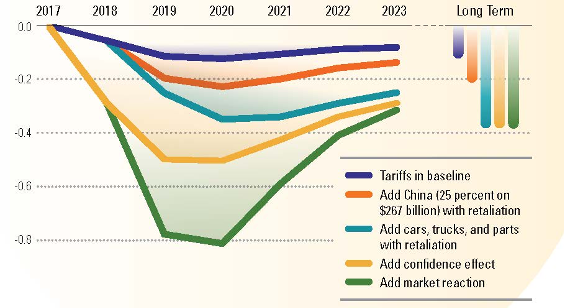

It is estimated that the tariff issue triggered by US policy will lead to an almost one percentage point2 deviation in global GDP in the 2020 – 2023 period, compared to the baseline.

GDP for the main western economies (the USA and the UK) and China slowed down in the first three quarters of 2019.

Macroeconomic context

(% change on the previous year)

| Captions | IMF3 | Revisions vs. July 2019 | |||

|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2019 | 2020 | |

| GDP | |||||

| Global | 3,6 | 3,0 | 3,4 | - | - |

| Advanced economies | 2,3 | 1,7 | 1,7 | (0,1) | - |

| Eurozone | 1,9 | 1,2 | 1,4 | (0,1) | (0,1) |

| Japan | 0,8 | 0,9 | 0,5 | - | 0,1 |

| UK | 1,4 | 1,2 | 1,4 | (0,1) | - |

| USA | 2,9 | 2,4 | 2,1 | (0,2) | 0,2 |

| Canada | 1,9 | 1,5 | 1,8 | - | (0,1) |

| Emerging market and developing economies | 4,0 | 4,2 | 4,6 | 0,1 | - |

| Brazil | 1,1 | 0,9 | 2,0 | 0,1 | (0,4) |

| China | 6,6 | 6,1 | 5,8 | (0,1) | (0,2) |

| India | 6,8 | 6,1 | 7,0 | (0,9) | (0,2) |

| Russian Federation | 2,3 | 1,1 | 1,9 | (0,1) | - |

| World trade | 3,6 | 1,1 | 3,2 | (1,4) | (0,5) |

Broadly speaking, this is not a new recessionary phase but a plateauing of GDP to more modest figures than those recorded until 2017, in a context where the possibility of macroeconomic intervention to cushion the softening of growth and trade appears less likely. International Monetary Fund projections for global import/export volumes over the forecast horizon have been revised downwards by more than three percentage points.

The USA performed strongly in the first half of the year, although the investment spending remained weak and the 2020 outlook is for a more moderate performance as the effects of the 2017 tax cuts which were not repeated in the 2019 – 2020 budget taper off. The effects the US trade policy will have on its domestic economy remain uncertain, while the Federal Reserve’s monetary policy continues to steadily wind back its accommodative stance. In September, the Federal Reserve decreased its target range for federal funds rates by 25 basis points to 1.75% – 2.0%, while continuing to focus on stability within the monetary system, which includes easing measures to ensure adequate interbank market liquidity levels in the short term.

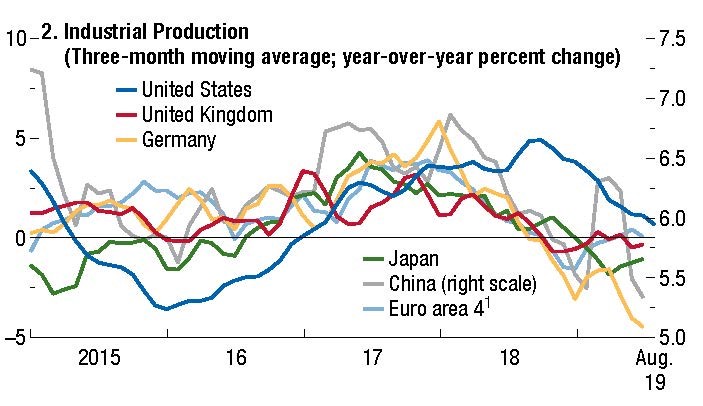

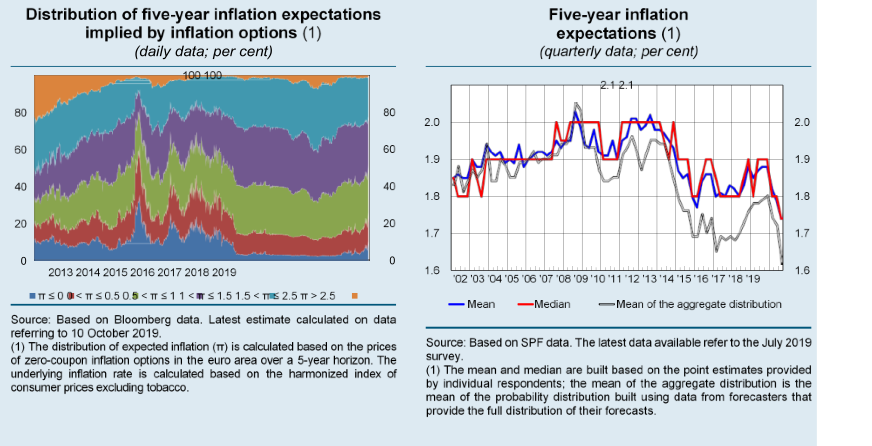

As reflected in the weaker industrial output, the Eurozone has been impacted by the contraction in foreign demand and the decrease in inventory, with both these factors affecting performance in the second half of 2018, particularly in Germany and France. Risks of decreases in inflation were also touted during the year, with projections of around 0.8%4 falling well short of the 2% target. To tackle this situation, the ECB has introduced expansionary measures to sustain growth and prices.

The situation in the United Kingdom has of course been impacted by the uncertainties linked to the process of its withdrawal from the European Union, even though the increased public spending announced by the government in the recent Spending Review quelled changes to the annual GDP projection. The projections are currently based on the assumption of the country’s orderly and gradual transition to its new structure.

Japan’s economy is tipped to grow around 0.9% in 2019, having been positively impacted by strong household consumption and public spending. The current government has announced expansionary fiscal measures to strengthen the trend for the current year.

The situation varies across the emerging markets, with the overall strong growth rates set to top 4% in 2020.

The main bodies have downgraded almost all areas, except for the European developing economies.

Asia remains the driving force, with 5.9% GDP tipped for 2019 and over 6% in 2020.

The downward revision of projected growth rates, for instance in China, is tied to the escalation of the tariff war and consequent softening of foreign demand.

India remains the most vibrant economy with vigorous 7% growth predicted for next year considering the economic policies, namely monetary easing and tax cuts for businesses.

The emerging economies of central and eastern Europe, especially Poland and Hungary, are growing strongly thanks to robust domestic demand and a generalised rise in wages.

Conversely, Turkey is impacted by political uncertainty and isolation, while analysts predict the Russian Federation will pick up strongly in 2020.

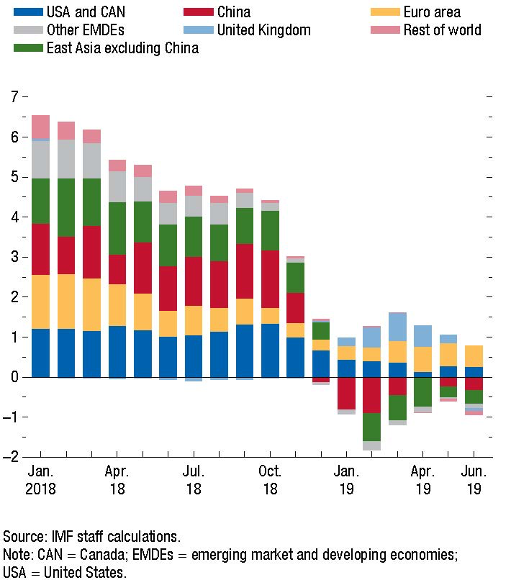

The greatest concern of analysts is global trade. As mentioned, this has been the main driver in the growth of countries’ economies over the years, as well as being a natural framework for dialogue and helping to ease international relations, though not without its issues.

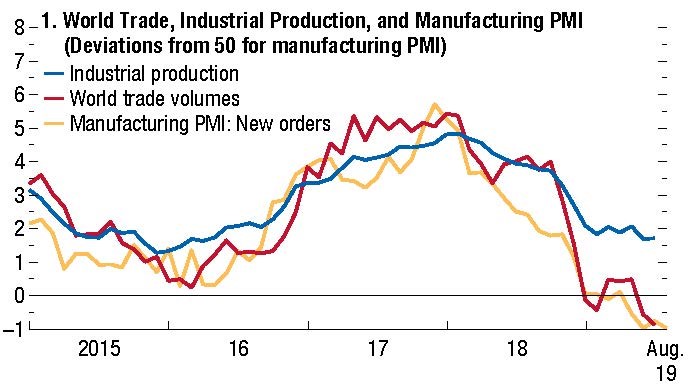

Initial inklings can be detected of concerns that the situation could become an issue in coming years. Global trade volumes for the first half of 2019 were just one percentage point higher than those or the previous year, the lowest half-year growth trend since 2012.

Oil prices fell during the summer months as a result not only of the general economic situation but also due to the contraction in the global demand for crude oil, in a context of uncertainty caused by tensions in the Middle East, including quite violent in the case of the attack on the Saudi Arabian facilities.

Industrial production in the Eurozone was negatively impacted by the German contraction, which was particularly evident in the capital goods sector, with a 1 percentage point decrease in the summer quarter from the previous quarter. The €-coin indicator developed by the Bank of Italy suggests a deteriorating underlying GDP trend in the Eurozone tending towards very modest figures.

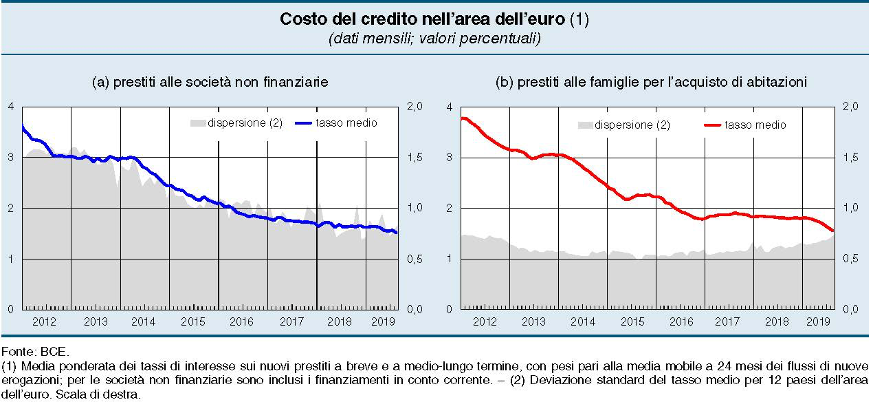

The monetary policy of the European Central Bank, whose head is going to change soon, has for now confirmed its intention to maintain favourable liquidity conditions and to generally continue with accommodating monetary policies, at least for as long as is necessary to stave off the risks of an inversion in the economic cycle. The measures of this type adopted by the Governing Council are the 10 base point decrease (to -0.50%) in the Eurosystem deposit rates and the resumption in November of the asset purchase programme, confirming the reinvestment of the principal redeemed from maturing securities.

The average cost of funding remains fairly low as a consequence of this policy, with a decrease in the interest rates on new loans to businesses and households.

The volume of loans granted to non-financial companies and households continued to grow in 2019, particularly strongly for companies in France and Germany.

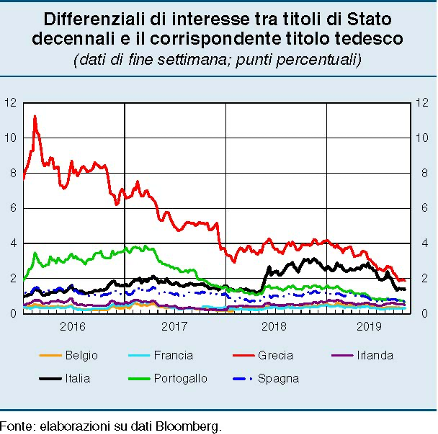

Long-term yields continued to fall in the third quarter of 2019 for some benchmark securities, such as the German ten-year bund6 and the Italian (-73 basis points) and Portuguese (-15 basis points) bond yield spreads. The spread also widened in France and Ireland during the quarter in a pattern suggesting volatility is based more on sentiment than on economic fundamentals.

Italy’s economy grew slightly in the first two quarters of 2019, turning around the trend of the latter part of 2018 on the back of domestic demand which seems to be positively impacted by the current household spending and investments in capital goods.

The introduction or resumption of tax incentives, such as fiscally-driven accelerated depreciation, have encouraged these trends and also generated improved business sentiment on investment and the economic situation in general7.

Qualitative indicators suggest the economic situation is still characterised by uncertainty, especially in relation to the overall performance of the Eurozone and of the main markets for Italian industrial production.

Provisional estimates indicate a 0.1% rise in GDP in the third quarter of 2019, continuing the trend of the last three quarters, and an estimated 0.2% growth for the year.

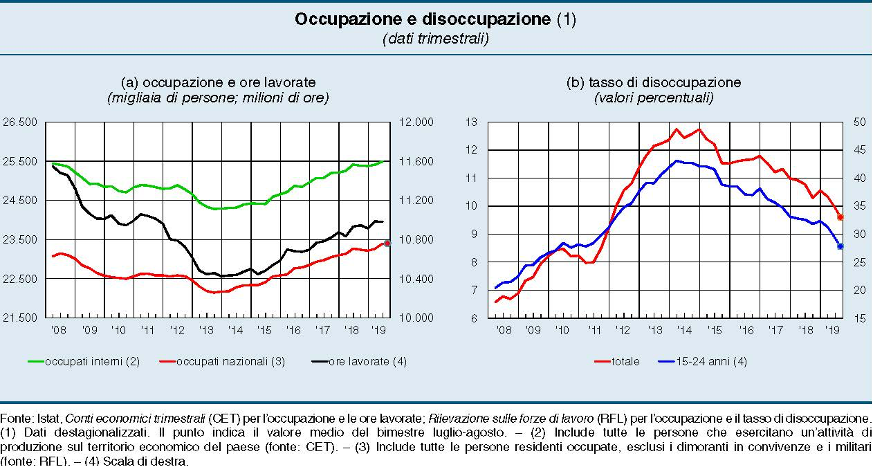

Employment rates rose to 59.2% in October 2019, and involved both genders; year-on-year, employment has grown by almost one percentage point8, and increased for all age groups, net of demographic changes.

The competitiveness of Italian and European businesses is also affected by the Euro’s performance against other main currencies, particularly the US dollar.

The Euro depreciated against the US dollar in the first three quarters of the year.

Currency fluctuations in the major advanced economies were fairly significant in the first half of 2019, with the Yen appreciating more than 5% between March and September and the Swiss Franc by 3% in real terms. Conversely, the Pound sterling depreciated by 4% over the same period as a result of concerns about a potential no-deal Brexit.

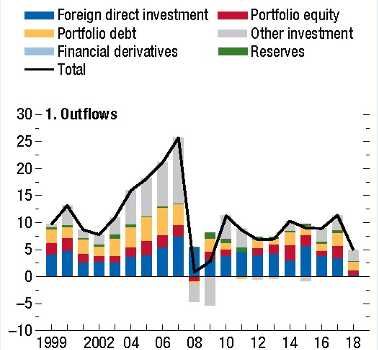

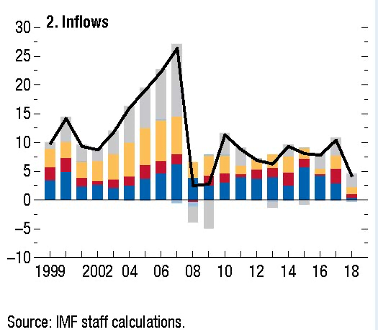

The US dollar strengthened by 2.5 percentage points, while the Euro depreciated by almost one and a half percentage points. One of the reasons behind these trends is the weak foreign direct investment (FDI9) inflows, which decreased significantly as from 2017 following the US tax reform.

FDI outflows and inflows of the advanced economies, which had risen at an annual rate of 3% since the end of the GFC and up until the previous year to approximately USD 1.8 trillion, began to nosedive in 2018.

The tax reform implemented by the US administration, which offered substantial tax relief to corporations repatriating foreign profits, generated a massive influx of profits accumulated by foreign subsidiaries in the 2011 – 2017 period.

Broadly speaking, the greatest influences on the macroeconomic situations are the elements of geopolitical uncertainty that condition the decisions of governments and operators. The policies adopted by the economies ranked as largest in a revised ranking can alter the risk levels and impact overall stability.

A key priority on the economic policy agenda should be eliminating elements of uncertainty such as a no-deal Brexit or the tariff war which are generating a crisis of confidence and sentiment in respect of the general outlook, before and even more than an actual contraction in the financial figures.

Indeed, multilateral policies based on greater cooperation between governments and economic organisations are needed in order to meet the universal commercial and technological needs.

The challenges of the coming years require a global and transversal view of the issues of international taxation, cash flow regulations, climate change and corruption issues. The greatest advantage can only be derived from greater integration between the various economies.

In this context, WTO tensions need to be resolved and the credibility of institutions restored. Policies to fight tax evasion and to bring tax competition among the various economies to within an agreed framework is an OECD aim that must be bolstered.

The security and stability of financial systems are still not complete after the global crisis that has affected the advanced economies in the recent past and reform measures should be implemented as per the models that have achieved wide consensus10. Cyber risk is opening up new frontiers for the dark side of finance, representing a new risk to stability.

The group’s policies are implemented in a framework offering opportunities but also risks. The former stem from the vibrancy of MAG’s markets and of those such as the emerging Asian areas with very strong growth rates and which are presently opening up to the aerospace sector.

The risks derive from the aforesaid economic uncertainties, which could influence the strategies of aircraft manufacturers or aerospace technology conglomerates in allocating their priorities for new projects.

As covered in greater detail in the relevant section (see Errore. L’origine riferimento non è stata trovata.), the fundamentals nevertheless remain solid and this industry’s long-term growth is projected to outstrip that of the general economy.

Global activity Indicators (Three-month moving average; year-over year percant change). Sources: CPB Netherlands Bureau for Economic Policy Analysis; Haver Analytics; Market Economics; and IMF staff calculations. Note: PMI = purchasing managers’ index. (1) Euro area 4 comprises France, Italy, the Netherlands, and Spain. ↩

IMF, “World Economic Outlook”, October 2019, reported in the IMF Annual Report 2019, Fig. 1.1, p. 6 (Percent Deviation from Control). ↩

IMF. WEO Report. “Overview of the World Economic Outlook Projections”. Table 1.1. ↩

Bank of Italy. “Economic Bulletin No. 4 – 2019”, 1.2. The Euro Area. The graphs are taken from the section entitled “Downside risks to inflation expectations according to the bank of Italy’s analyses”. ↩

Contribution to Global Imports, Percentage points, three-month moving average. ↩

Between July and October 2019, the German ten-year bund yield decreased 10 basis points to -0.45%. ↩

ISTAT, Monthly Report of Italian Economy, October 2019. Press release of 11 November 2019. ↩

ISTAT, Employment and unemployment, October 2019. Press release of 29 November 2019. ↩

Foreign direct investments. ↩

T.Adrian, d. Laxton, M. Obstfeld, “Advancing the Frontiers of Monetary Policy”. IMF, 2018 ↩

![MAG Annual Report 2019 [EN]](https://finance.mecaer.com/2019en/wp-content/uploads/sites/8/2020/06/Logo_up_big_2.png)